What Does Your Tax Money Go To

9 Minute Read | September 27, 2021

If you're like most folks, the first two questions that pop into your head when you look at your tax return each year are "How much did I make?" and "How much did they take?"

Who are "they"? The federal government, of course.

And while you grumble about how much Uncle Sam takes out of your paycheck every two weeks, there's another question you might wonder about: What are "they" doing with my tax dollars, anyway?

That's a great question . . . especially since the IRS collects around $3.5 trillion in federal taxes each year paid by hardworking taxpayers like you.1 That's trillion—with a "T"!

The IRS can seem like a riddle, wrapped in a mystery, inside an enigma: Money goes in, a lot less comes out, but what it does in between those two steps is anyone's guess.

Well, not anymore. It's time to pull back the curtain and find out where your tax money goes.

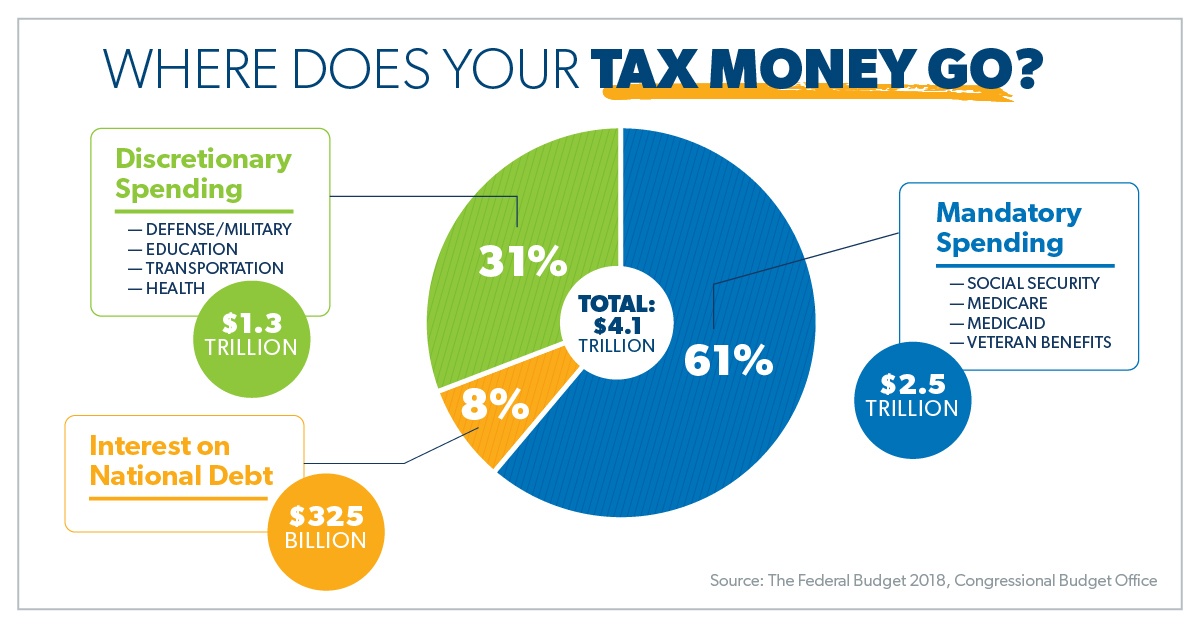

Basically, there are three main categories that your tax money pays for:

- Interest on government debt (8%)

- Mandatory spending, also known as entitlement spending, which is not subject to regular budget review (61%)

- Discretionary spending, which is spent on programs that Congress must regularly review and set aside for a specific purpose (31%)2

Get your taxes done right by the best in the business!

Pretty broad, right? Let's break it down and see where your money really ends up.

Interest on Government Debt

Let's just say that Uncle Sam is not exactly working the Baby Steps. The U.S. government is currently more than $23 trillion in debt—and counting—with 8% of your tax dollars going toward paying the interest on that debt.3

The interest on the national debt, which must be paid by the federal government each year, changes based on two factors—the size of the debt itself and rising and falling interest rates. And since both the national debt and the interest rates on that debt are expected to increase over the next decade, so will the size of our nation's interest payments—which means more of our taxpayer dollars might be used to make those payments.4

Maybe it's time to finally get Washington on the debt snowball . . .

Mandatory Spending

Let's talk entitlements. These are Social Security, Medicare, Medicaid, and Veterans Affairs benefits and services. They're called entitlements because the government takes money out of your paycheck to fund them, so you're entitled to these benefits once you meet certain conditions.

This category of spending has gone way up since 1962, and there are two main reasons why. First, there was the introduction of new entitlements such as Medicare and Medicaid (started in 1965), the earned income tax credit (also known as the EITC, started in 1975), and the child tax credit (1997). Second, the population receiving these benefits has exploded as Baby Boomers enter retirement age, start collecting Social Security benefits, and enroll in Medicare.5

All of these factors, plus a handful of benefits for our military veterans, bring mandatory spending's piece of the pie to almost two-thirds (61%) of the federal budget in 2018. Let's take a look at some of the big pieces.

Social Security

Social Security was created in 1935 to provide income for retired workers over the age of 65 and accounts for more than a third (39%) of mandatory spending. It's designed to supplement your income when you retire or become disabled. If you were to die before you become eligible, your dependents would receive benefits.

The types of people who receive Social Security benefits are:

- Retired workers and their families

- Disabled workers and their families

- Survivors of deceased workers6

Social Security taxes and benefits are tied to inflation, which means they go up as things get more expensive. How much does the average person on Social Security receive every month? Here's a quick breakdown:

| All Retired Workers | $1,503 |

| Aged Couple, Both Receiving Benefits | $2,531 |

| Widowed Mother and Two Children | $2,934 |

| Aged Widow(er) Alone | $1,422 |

| Disabled Worker, Spouse and One or More Children | $2,176 |

| All Disabled Workers | $1,258 |

According to the Social Security Administration, about 64 million Americans received more than $1 trillion in benefits in 2019.8 Let that sink in for a second.

All these benefits are paid for through a 6.2% payroll tax on your earnings, which is only taken out up to the "maximum earnings limit." That limit was $132,900 for 2019 and $137,700 for 2020.9 That just means that no taxpayer will pay more than $8,537.40 in Social Security taxes in 2020.

Now, you're probably looking at that average monthly benefit of $1,503 per month and thinking to yourself, "Wow, that is not enough money to live on!" Well, you're right! Social Security is meant to be a supplement to your retirement income.

That's why it's so important to save at least 15% of your income for retirement. If you have questions about saving for retirement, contact one of our SmartVestor Pros and start making a plan.

Medicare

There's no way around the fact that health care is expensive—especially when you're in your retirement years. That's where Medicare comes in.

Medicare has been in the news a lot lately, but what exactly is it? In a nutshell, Medicare is a federal health insurance program created in 1965 that provides coverage for several groups of people:

- People over age 65

- Certain younger people with disabilities

- People with End-Stage Renal Disease (ESRD, which is permanent kidney failure that requires dialysis or a transplant)

You can basically break down Medicare into three different "parts":

- Medicare Part A: Generally covers hospital stays, a portion of care in a nursing facility, hospice care and some home health care

- Medicare Part B: Covers doctor visits, outpatient services, medical supplies and preventive care

- Medicare Part D: Covers prescription drugs

There's also a Medicare Part C, also called Medicare Advantage, that is a bundled alternative consisting of all parts together in one plan.10

In 2018 (the most recent year data is available), Medicare took up 28% of all mandatory spending, totaling $705 billion to cover roughly 60 million Americans under the program.11

Who pays for all this? Most of it is on your dime! American taxpayers fund Medicare through a 1.45% payroll tax on all of their earnings. But unlike the Social Security tax, there's no maximum earnings limit. The Affordable Care Act also added an additional 0.9% tax on earned income over $200,000 ($250,000 for married couples).12, 13

Medicaid

Like Medicare, Medicaid is a government-sponsored insurance program that provides health coverage for low-income adults, children, pregnant women, elderly adults and people with disabilities.14

Medicaid takes up another big piece of national health care spending, with the federal government spending $389 billion to fund the program in 2018. But total Medicaid spending was actually $597 billion—so how's that possible? The federal government splits the cost of Medicaid with state governments. And the states get the better deal—in some cases, Uncle Sam pays 75% of their Medicaid costs.15,16

Veterans Benefits

Mandatory veterans benefits include disability compensation, burial benefits, pensions, education, job training and rehabilitation, insurance and housing programs.17

These are the big programs that are funded by mandatory spending. While some of the money for these programs (Social Security and Medicare) comes out of your check automatically, some (including money for veterans benefits) comes from taxes on your earned income and things like capital gains.

Plus, more of these benefits for our veterans are covered under discretionary spending. Speaking of which . . .

Discretionary Spending

Discretionary spending is the last piece of the puzzle when it comes to how your tax money is spent. Every year, Congress dukes it out over who gets how much money when they debate spending bills. In other words, these programs are subject to Congress' discretion, meaning they can decide to increase or decrease funding for certain programs as they see fit.

Let's take a look at some of the major categories covered under discretionary spending.

National Defense

Defense spending accounts for about half of all discretionary spending at 48%. 18 This funds the Department of Defense and all of its operations, including active military engagements in Iraq and Afghanistan.

Transportation

Funding for planes, trains and automobiles accounts for about 7% of discretionary spending. 19 This pays for roads and bridges, air traffic control and the Department of Transportation.

Education

Education, training and employment services take up another 7% of discretionary spending.20 This is mainly through the Department of Education and covers everything from paying teachers' salaries to funding grants to pay for college. Unfortunately, this also includes funding for federal student loans. Womp, womp.

Veterans Benefits

While some veterans benefits are mandatory expenditures, about 44% of the Veterans Administration (VA) budget comes from discretionary funds set aside by Congress, making it about 6% of all discretionary spending.21 , 22 This covers things like medical care, construction of VA facilities, and IT services at those facilities.

Health

About 5% of discretionary spending goes to fund agencies like the Centers for Disease Control (CDC), the Food and Drug Administration (FDA) and the National Institute of Health (NIH). 23 These agencies research diseases and new drug therapies, oversee food safety, and fund medical research.

Get Some Guidance on Your Taxes

Whew! Now you know where your money goes. We get it, taxes are complicated—but that doesn't mean they have to be stressful. (You know, other than not having that money in your bank account.)

Take our quick tax quiz to see how complex your situation is and find the starting point that's best for you—you may need a pro's help, or it might make sense to do them yourself with tax-prep software.

And if you do need help, our tax Endorsed Local Providers (ELPs) are here for you.

Find your tax pro today!

What Does Your Tax Money Go To

Source: https://www.ramseysolutions.com/taxes/where-does-your-tax-money-go

Posted by: chavarriapoodut84.blogspot.com

0 Response to "What Does Your Tax Money Go To"

Post a Comment