How To Transfer Money From Indian Bank To Usa

Compare the best money transfer rates to the United States

At Wise, we never hide extra fees and charges in the exchange rate. We just use the exchange rate – independently provided by Reuters. That means fair, low-cost transfers, every time.

Compare Wise exchange rates and fees with some of the biggest money transfer and remit services, such as Barclays, MoneyGram or WorldRemit.

Start saving now

How to send money to the United States in 3 easy steps

1

Start your transfer.

Pay in INR with your debit card or credit card, or send the money from your online banking.

2

Get the best rate out there.

Wise always gives you the real and fair mid-market exchange rate.

3

Money is locally delivered.

The recipient gets money in their currency directly from Wise's local bank account.

How much does it cost to transfer money to the United States?

To send money in INR to the United States, you pay a small, flat fee of 75.2 INR + 1.78% of the amount that's converted (you'll always see the total cost upfront).

Some payment methods have an added fee, but that's usually tiny too.

No big fees, hidden or otherwise. So it's cheaper than what you're used to.

| Wise Fees | |

|---|---|

| Fixed fee | 75.2 INR |

| % fee for transfers up to 1,00,55,900 INR | 1.78% |

| % fee for transfers up to 3,01,67,700 INR | 1.68% |

| % fee for transfers up to 5,02,79,500 INR | 1.63% |

| % fee for transfers up to 10,05,59,000 INR | 1.62% |

| % fee for amounts over 10,05,59,000 INR | 1.61% |

How long will a money transfer to the United States take?

On many popular routes, Wise can send your money within one day, as a same day transfer, or even an instant money transfer.

Sometimes, different payment methods or routine checks may affect the transfer delivery time. We'll always keep you updated, and you can track each step in your account.

Your transfer route

Should arrive

by November 12th

Save when sending money to the United States

Wise is easy

How to send money to the United States from India

Wise makes transferring money to the United States a breeze:

- Just tap in how much, and where to.

- Then make a local payment to Wise, whether it's with a bank transfer, swift or your debit or credit card.

- And that's it.

Wise converts your money at the 'inter-bank' rate – the real rate – so you save big time (even versus the guys saying there's 'zero' commission). On Wise, there's no room for sneaky bank surcharges or creeping hidden charges.

Available payment methods

- Bank Transfer

The best ways to send money to the United States

Choosing the right way to send money with Wise will largely depend on your payment method. Some payment methods are faster than others. Some can be instant, while others are cheaper.

Here are the best ways to transfer money to the United States with Wise:

-

Bank Transfer

Bank transfers are usually the cheapest option when it comes to funding your international money transfer with Wise. Bank transfers can be slower than debit or credit cards, but they usually give you the best value for your money. Read more how to use bank transfers as a payment option here.

What you'll need for your online money transfer to the United States

-

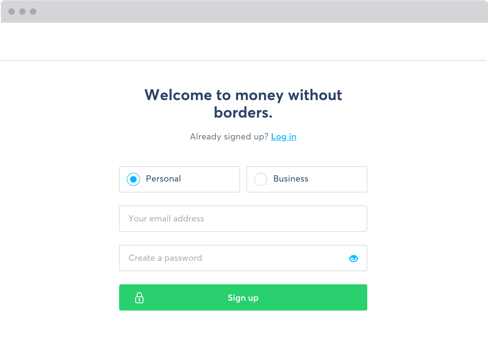

1. Create your free account.

Click 'Sign up', then create your free account. It takes seconds. You can do it on our website or with our app. All you need is an email address, or a Google or Facebook account.

-

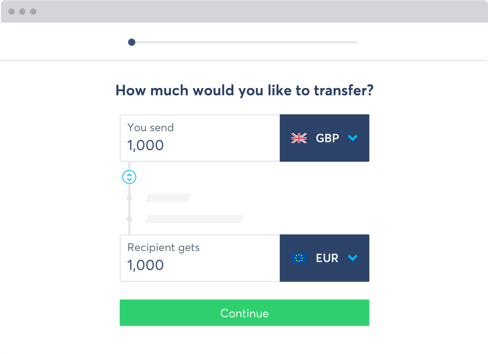

2. Set up your first transfer.

Use our calculator to tell us how much money you want to send, and where you want to send it. You'll see our fees upfront. We'll tell you when your money should get there, too.

-

3. Tell us a little about yourself.

We'll ask you if you're sending money as an individual or business. We'll also need your full name, birthday, phone number, and address. You know, the standard stuff.

-

4. Tell us who you're sending to.

Yourself? Someone else? A business or charity? Pick your answer. Then we'll ask you for some basic information about your recipient, including their bank details. They need a bank account, but they don't need a Wise account. (Though we hope they'll want one soon.)

-

5. Make sure everything looks good.

We'll show you a summary of your transfer. If everything looks good, click Confirm. You can also make any changes you need to.

-

6. Pay for your transfer.

Would you like to pay by bank transfer? Debit or credit card?Make your choice, and we'll tell you how to do it. Each payment method has its own steps, but they're all straightforward and should only take a few minutes.

Wise is safe and secure

Wise is an authorised Electronic Money Institution independently regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

This means we're required by law to keep your money safe by storing it in a low-risk financial institution - in Europe this is in our UK account with Barclays, in the US this is in our US account with Wells Fargo.

We're trusted by 10 million people and counting.

We have a 4.6 out of 5 rating on Trustpilot

It's your money. You can trust us to get it where it needs to be, but don't take our word for it. Read our reviews at Trustpilot.com

Everything works properly.

Balint Szanyi

Published 53 minutes ago

Instant safe transfer...every time!!

norma elliott

Published 1 hour ago

Brilliant service and surprisingly low charges if you use a payment direct from your bank. Have used them for many years now and have recommended to s...

Graham Porter

Published 1 hour ago

Save money when sending money to the United States

Transfer your Indian rupee to United States dollar today with Wise.

Create free account now

FAQs

Choosing the right way to send money with Wise will largely depend on your payment method. Some payment methods are faster than others. Some can be instant, while others are cheaper. Find out here what are the best ways to transfer money to the United States with Wise.

Yes. Wise is an authorised Electronic Money Institution independently regulated by the Financial Conduct Authority (FCA) in the United Kingdom. Learn more

Yes, there are limits for how much you can send to the United States with us. They depend on which currencies you send to and from, and how you pay. You can check the limits for each currency in our help center articles or in our calculator. We'll also let you know if you try to send too much at one time.

If you'd like to send more than our limits allow, you can. You'll just need to set up several transfers that are under the limits.

On many popular routes, Wise can send your money within one day, or even within seconds. Sometimes, different payment methods or routine checks may affect the transfer delivery time. We'll always keep you updated, and you can track each step in your account.

See how long a money transfer to the United States takes.

- Register for free

Sign up online or in our app for free. All you need is an email address, or a Google or Facebook account. - Choose an amount to send

Tell us how much you want to send. We'll show you our fees upfront, and tell you when your money should arrive. - Add recipient's bank details

Fill in the details of your recipient's bank account. If you don't know their details, we can request them for you. - Verify your identity

For some currencies, or for large transfers, we need a photo of your ID. This helps us keep your money safe. - Pay for your transfer

Send your money with a bank transfer, or a debit or credit card. - That's it

We'll handle the rest. You can track your transfer in your account, and we'll tell your recipient it's coming.

How To Transfer Money From Indian Bank To Usa

Source: https://wise.com/in/send-money/send-money-to-the-usa

Posted by: chavarriapoodut84.blogspot.com

0 Response to "How To Transfer Money From Indian Bank To Usa"

Post a Comment